403b loan calculator

How This 401k Loan Calculator Works. The loan amount is not taxable either.

Financial Calculators

403 b plans are only available for employees of certain non-profit tax-exempt organizations.

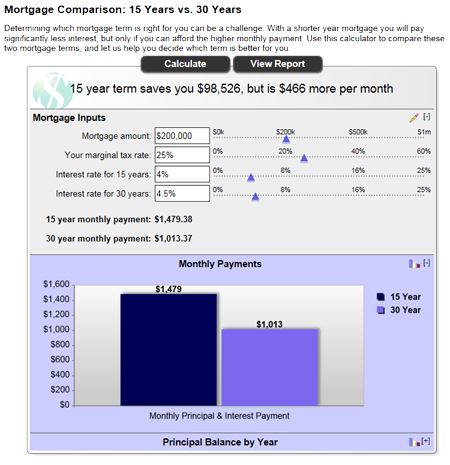

. 900 1800 2700 3600 1883 3322 Plan Loan Alternative Loan Foregone investment return Total interest over the term of the loan. Loans and even home equity loans are generally more advantageous than a 403b loan when the interest can be deducted from your income for tax purposes. Retirement Savings and Planning.

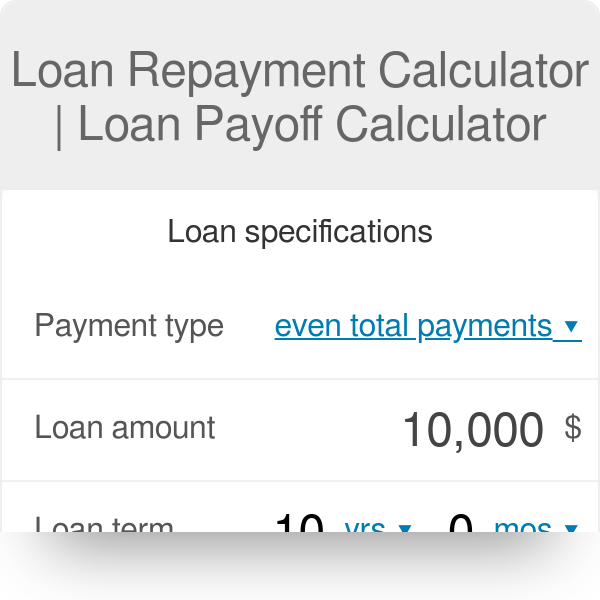

This calculator assumes that your return is compounded annually and your deposits are made monthly. The annual rate of return for your 403 b account. You can then examine your principal balances by payment the.

The actual rate of return is largely. This calculator assumes that your return is compounded annually and your deposits are made monthly. Or if you prefer enter the monthly amount you can afford and the calculator will determine a corresponding loan amount.

A 403 b is a type of tax sheltered annuity plan which allows you to invest pretax earnings in a retirement account and allow those funds to grow tax-free as well. The contribution limit for 2022 is 20500 19500 in 2021. Begin by entering your 401k loan amount.

The actual rate of return is largely. Brandon Renfro PhD CFP. You are only taxed on the.

Subject to the terms of your employers plan you may be able to take a loan from your plan account. 1 Does the written 403b plan allow for participant loans. Calculate your earnings and more.

Can I take a loan from my plan account. The annual rate of return for your 403 b account. The majority of 401 k plans and a growing number of 403 b plans let you borrow money from your account.

The annual rate of return for your 403 b account. To find out if your plan permits loans and to initiate. The actual rate of return is largely.

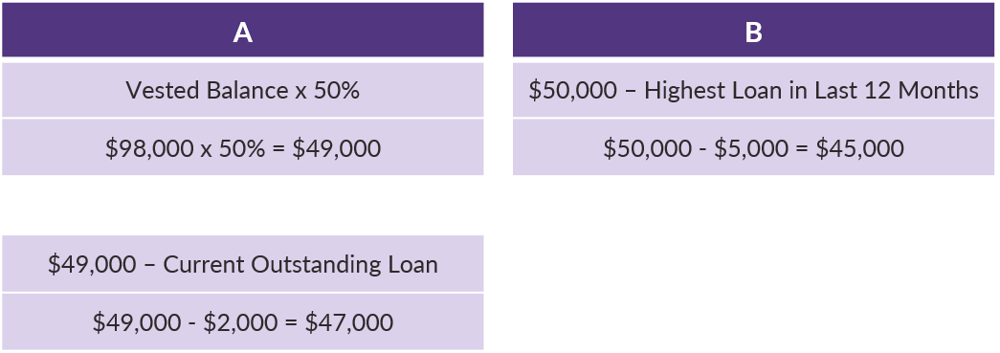

This 403b calculator can help you whether you need to know how much you should be contributing to your 403b or if you are nearing retirement and want help. This calculator assumes that your return is compounded annually and your deposits are made monthly. A typical plan would allow you to borrow up to 50 of your balance but not more.

Since many 403b plans attempt to. Unlike regular contributions to your 403b loan repayments do not count toward your contribution limits. A loan is a contract between a borrower and a lender in which the borrower receives an amount of money principal that they are obligated to pay back in the future.

The actual rate of return is largely. The 403b written plan must first contain language allowing loans to participants. 501c 3 Corps including colleges universities schools.

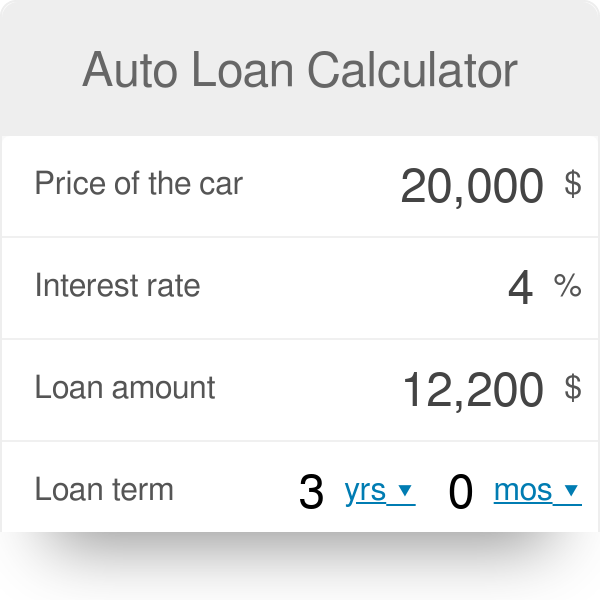

In order to qualify for a 403b loan. According to Integrity Wealth Advisors the typical 403b loan interest rate is the prime rate plus 1. Loan Calculators Simple Loan.

This 401k loan calculator works with the user entering their specific information related to their 401k Loan. This calculator assumes that your return is compounded annually and your deposits are made monthly. 403b plans are only available for employees of certain non-profit tax-exempt organizations.

The annual rate of return for your 403 b account. Online Financial Calculator Borrowing From a 401k or 403b Calculator - The majority of 401k plans and a growing number of 403b plans let you borrow money from your account.

Loan Repayment Calculator

Auto Loan Calculator

The Pros And Cons Of Borrowing From Your Retirement Plan Equitable

Financial Calculators Service2client S Website Tools

2

2

2

/403_b_plans_-5bfc2f6346e0fb00511a625c.jpg)

Can I Have Both A 403 B And A 401 K

401k Loan Calculator 401k Loan Repayment Calculator

2

How Do 403 B Loans Work

Roth 403b Vs Roth Ira Key Differences Smartasset

How Do I Calculate How Much Money Is Available For A 401 K Loan

Calculators Act 1st Federal Credit Union

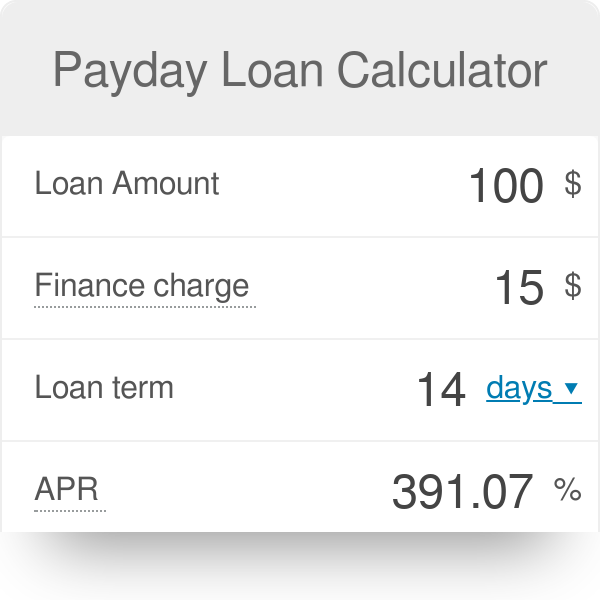

Payday Loan Calculator

401k Loan Calculator 401k Loan Repayment Calculator

403b Calculator